What is Tax and Tax Types, and What is GST? (2016)

(2017)

What is Tax?

Tax is an

obligatory contribution to the state revenue; the government of India levy on

the income of workers and business gains or added up to the cost of some

transactions, goods and services.

The government

levies taxes on the citizens of the country to produce income for business

projects to enhance the country’s economy and to lift up the standard of living

of the nationals. The government’s authority to a levy tax in our country is

drawn from the Constitution of India that deals out the supremacy to levy taxes

to the State as well as Central governments. All the taxes levied within the

country require being backed by an escorting law passed by the State

Legislature or the Parliament.

Types of Taxes:

There are two

types of taxes namely, direct taxes and indirect taxes. The implementation of

both the taxes differs. You pay some of them directly, like the cringed income

tax, corporate tax, and wealth tax etc while you pay some of the taxes

indirectly, like sales tax, service tax, and value added tax etc.

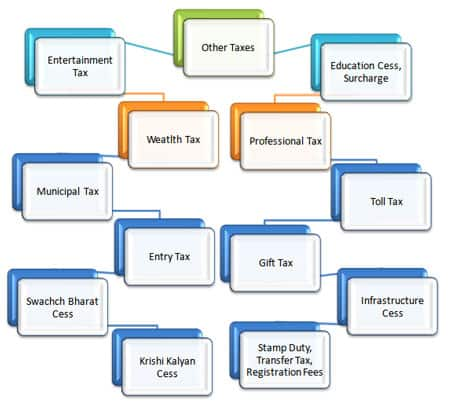

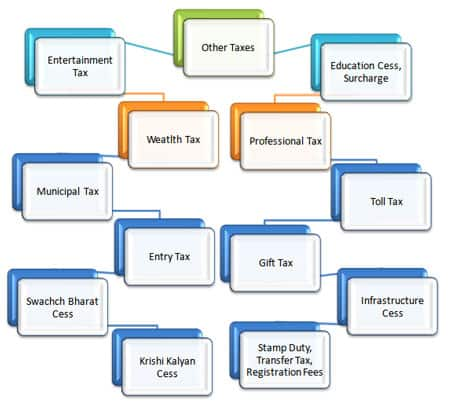

However, apart

from these two traditional taxes, there are other taxes also, which has been

affected to serve a specific agenda by the country’s Central Government. ‘Other

Taxes’ are imposed on both the taxes, direct and indirect tax like the

currently launched Swachch Bharat Cess Tax, Infrastructure Cess Tax, and Krishi

Kalyan Cess Tax among others.

Direct Tax:

What is Direct Tax?

As stated

earlier, you pay these taxes directly. The government levy such taxes directly

on an individual or an entity and it cannot get transferred to any other person

or entity. There is only one such federation that winks at the direct taxes,

i.e. the Central Board of Direct Taxes (CBDT) governed by the Department of

Revenue. The CBDT has, to assist it with its sense of duties; the backup of

several acts that preside over several aspects of the direct taxes.

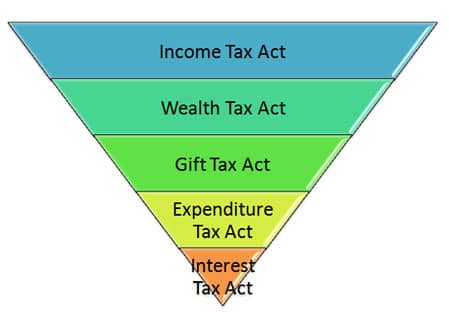

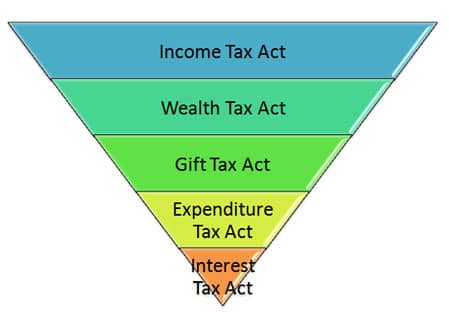

A few of these

acts are as under:

· Income Tax Act:

Income Tax Act is

also called the IT Act, 1961. Income Tax in India is governed by the rules set

by this act. The income taxed by this act can be generated from any source such

as profits received from salaries and investments, owning a property or a

house, a business, etc. The IT Act defines the tax benefit you can avail on a

life insurance premium or a fixed deposit. It also decides the savings from

your income via investments and the tax slab for your income tax.

· Wealth Tax Act:

The Wealth Tax

Act came into effect in the year 1951 and is in charge of the taxation linked

with an individual’s net wealth, a Hindu Unified Family (HUF) or a company. The

easiest computation of wealth tax was:

If the net wealth

of an individual exceed Rs. 30 lakhs, then 1 percent of the exceeded amount is

payable as a tax. It was put to an end in the budget that was announced in

2015. Since then, it has been substituted with a surcharge of 12 percent on the

individuals that generate an income more than Rs. 1 crore p.a. It is also

pertinent to the companies, which have generated revenue of over Rs. 10 crores

p.a. The fresh guidelines radically raised the sum the government would

accumulate in taxes as disparate the amount they would accumulate via wealth

tax.

· Gift Tax Act:

This Act was

brought into existence in the year 1958 and assured that if a person received

gifts or presents, valuables or monetary, he has to pay a tax on those gifts.

The tax on aforementioned gifts was sustained at 30 percent but it was put to

an end in the year 1998. Originally, if a gift was given, and it was somewhat

like shares, jewellery, property etc it was subject to tax. As per the new

rules, the present given by the members of the family like parents, spouse,

uncles, aunts, sisters and brothers are not subject to tax. Even presents you

receive from the local authorities are also exempted from such taxes. If

somebody, other than that of the exempted entities, presents you anything,

which has a value beyond Rs. 50,000 then the whole gift amount is subject to

tax.

· Expenditure Tax Act:

The Expenditure

Tax Act came into existence in the year 1987 and cope with the expenditure made

by you, as a person, may incur whilst you avail the services of a restaurant or

a hotel. It is appropriate to the entire nation other than Jammu and Kashmir.

It asserts that some expenses are liable under the act if the amount is beyond

Rs. 3,000 contingent upon a hotel and all the expenses drawn in a restaurant.

· Interest Tax Act:

This Act of 1974

copes with the tax, which was chargeable on interest produced in some specific

situations. In the Act’s last amendment, it is stated that this act is not

applicable to interest earned after March 2000.

Here are a few

examples of several kinds of direct taxes:

2.

Capital Gains

Tax:

Capital Gains Tax

is payable whenever you get a considerable sum of money. It could be from the

sale of any property or from an investment. This is generally of two types,

namely long-term capital gains from the investment made for a period of more

than 36 months and short-term capital gains from the investments made for not

more than 36 months. The tax that is applicable for each of these is also

different since short-term gains tax is computed basis the income bracket,

which you fall in and the long-term capital gain tax is 20 percent. The

interesting thing about the capital gain tax is that the profit does not always

should be in the money form. It could also happen to be barter in kind in this

the worth of the exchange will be taken into consideration for taxation.

3.

Securities

Transaction Tax:

It is not a tough

nut to crack to know about the proper trading on the stock market, and exchange

securities, you stay still to make an extensive sum of money. This too is a

mine of income but has its own tax that is called as the Securities Transaction

Tax. How is this tax levied? This tax is levied by combining the share’s price

and the tax. This means every time you purchase or sell a share, you make

payment of this tax. All the securities traded on Indian Stock Exchange, have

this affixed with them.

4.

Perquisite Tax:

Perquisites are

all the privileges and perks that the employers might pull out to the

employees. These civil liberties may include a car provided for your use or a

house, given by the company. These perquisites are not just confined to big

compensations such as houses or cars; they may even include things such as

compensation for phone bills or fuel. The perquisite tax is levied by

discovering how the company acquires the perk of how the employee uses it. In

case of cars, it might be so that the company provides a car and the employee

uses it for both official and personal purposes qualifies for tax while the car

used for official purposes only is not eligible for tax.

5.

Corporate Tax:

The income tax a

company pays from its revenue earned by it is called a corporate tax. The

corporate tax also has a slab of its own, which decides the amount of tax to be

paid. For instance, a domestic firm that earns revenue of not more than Rs. 1

crore p.a. will not have to pay such tax. It is also made known as a surcharge

and it is different for distinct revenue brackets. This tax is also different

for the international companies where this tax may be 41.2 percent of the

revenue earned by the company is not more than Rs. 10 million and above.

There are four

types of corporate taxes. They are:

Minimum Alternate Tax:

Minimum

Alternative Tax (MAT) is fundamentally a means for the IT Department to get the

companies to make payment of a minimum tax that presently stands at 18.5

percent. This type of tax came into existence when the Section 115JA of the IT

Act was introduced. Nevertheless, the companies that are involved in power

sectors and infrastructure are exempted from making payment of MAT.

Once the MAT is

paid by the company, it can cart the payment forward and adjust against the

regular tax payable for the period of the succeeding five-year duration liable

to be subjected to specific conditions.

Fringe Benefit Tax:

Abbreviated as

FBT, was a tax that was applied to nearly all the fringe benefits an employee

receives from its employer. This tax covers several aspects such as:

· Employee

Accommodation, entertainment and welfare, the employer’s expenditure on travel

(LTA)

· Employer

Stock Option Plans (ESOPs)

· The

contribution made by the employer to a registered retirement fund

· Any

commute related expenditure or regular commute offered by an employer

The FBT was

initiated under the stewardship of the Government of India from April 1, 2005.

Nevertheless, Pranab Mukherjee, the-then Finance Minister abandoned it in 2009

while the Union Budget Session 2009.

Dividend Distribution Tax:

This tax was

brought in after the end of Union Budget 2007. It is fundamentally a tax that

is levied on the companies that depend on the dividend paid by them to their

investors. The Dividend Distribution Tax is chargeable on the net or gross

income of an investor received from the investments made by them. Presently,

the DDT rate is 15 percent.

Banking Cash Transaction Tax:

This tax is yet

another type of tax, which the Government of India has scrapped. This type of

taxation was into effect from 2005 to 2009 until Mr. Pranab Mukherjee, the-then

Finance Minister, wiped out the tax. Under this tax, every bank transaction,

credit or debit, would be levied tax at a rate of 0.1 percent.

Indirect Tax:

What is Indirect Tax?

The taxes levied

on goods and services are referred to as indirect taxes. They are different

from direct taxes as they are not imposed on an individual who shells out them

directly to the Indian government, they are, as an alternative, imposed on the

products and an intermediary, the individual selling the product, collects

them. The most trivial examples of the indirect taxes are Sales Tax, Taxes

levied on imported goods, Value Added Tax (VAT), etc. Such taxes are imposed by

summating them with the price of the product or service that likely to push the

price of the product up.

A few of these

are:

Types

of Indirect Taxes:

The most common

forms of indirect taxes are as under:

1.

Sales Tax:

The tax imposed

on the sale of any product is called sales tax. This product can be anything

produced in India itself or imported and can also cover services provided. The

sales tax is levied on the product’s seller who then passes it to the

individual who buys the said product with this tax summated to the product’s

price. The constraint with this tax is that such a tax is imposed on a

particular product that means if the product is re-sold; the seller cannot

apply sales tax on it.

Fundamentally,

all the states in India follow their individual Sales Tax Act and a percentage

native to them is charged. Besides this, other additional charges such as works

transaction tax, turnover tax, purchase tax, and the similar taxes are levied

in a few states. This is also one reason that sales tax was considered as one

of the largest revenue producers for a number of state governments. In

addition, the sales tax is imposed under both the State and Central

Legislation.

2.

Service Tax:

As sales tax, the

service tax is also summated to the price of the product sold in the country.

In Budget 2015, the FM announced that the rates of service tax will be elevated

to 14 percent from 12.36 percent. It is not charged on goods but on the

companies that offer services and once every quarter or every month it is

collected on the way services are offered. If the organisation is an individual

service provider then the payment of service tax is made only once the bills

are paid by the customer. However, for firms, the service tax is to be paid as

soon as the invoice is raised, heedless of the payment of the bill by the

customer.

You must remember

that since the service offered at restaurants is a combo of the premises, the

waiter and the food, it is tough to point to be eligible for service tax. To

abolish haziness, in this regard, there was a declaration made that the

restaurants will charge service tax on 40 percent of the total bill.

Goods

and Service Tax-GST:

The GST, i.e.

Goods and Service Tax is the biggest reform in the structure of Indirect Tax in

India since the market began unlocking 25 years back. The goods and services

tax is a consumption-based tax because it is chargeable where the consumption

is taking place. The GST is imposed on the value-added services and goods at

every stage of consumption in the supply chain. The GST chargeable on the

acquisition of the goods and services can be redeemed against the GST

chargeable on the supply of the goods and services, the vendor will have to

make payment of the GST on the applicable rate but he can claim it back via the

tax credit method.

3.

Value Added Tax:

Value Added Tax

(VAT), popularly known as commercial tax is not chargeable on the commodities,

which are zero rated for food and necessary drugs or those falling under

exports. VAT is imposed at all the steps of the supply chain, from

manufacturers to dealers to distributors to the end user.

The VAT was a tax

imposed at the prudence of the state government of the country. Not all the

states put it into practice when it was announced. The VAT is imposed on

several goods that were sold in the state and the state itself decided the

amount of tax.

4.

Customs Duty and

Octroi:

While you buy

anything that requires being imported from abroad, you are applied a charge on

it and that is known as the customs duty. It is applied to all the products,

which come in via air, sea or land. Although you acquire products bought in

different country to India, you will be charged a customs duty. The intention

of the customs duty is to make sure the goods that enter the country are taxes

and are paid for. Like the customs duty makes sure that the goods for different

countries are levied taxes, Octroi is supposed to make sure that the goods

traversing the state borders inside India are appropriately taxed. The state

government levies this and functions in almost the same way as that of the

customs duty.

5.

Excise Duty:

The excise duty

is such a tax that is imposed on all the manufactured goods or the produced

goods in India. This tax varies from customs duty as it is chargeable only on

the things that are produced in India and is also called the Central Value

Added Tax or CENVAT. The government collects this tax from the manufacturer of

goods, also from the entities, which receive manufactured products and provide

work for people to transport the products from manufacturer to them.

The Central

Excise Rule framed by the Central Government of India suggests that every

individual that manufactures or produces any ‘excisable goods or products’, or

who stockpile such products in a depot, will have to make payment of the duty

chargeable on these goods. Under this scheme, no excisable products, on which

some duty is payable will be permitted to move without making payment of duty

from any point6, where they are manufactured or produced.

(2017)

What is GST?

Goods and Services Tax (GST)

is an indirect tax (or consumption tax) imposed in India on

the supply of goods and services. It is a comprehensive multistage, destination

based tax. Comprehensive because it has subsumed almost all the indirect taxes

except few. Multi-Staged as it is imposed at every step in the production

process, but is meant to be refunded to all parties in the various stages of

production other than the final consumer. As a destination based tax, as it is

collected from point of consumption and not point of origin like previous

taxes.

Very informative post, it was quite helpful to me.

ReplyDeleteThank you for sharing this post. This is very useful information.

For information regarding GST registration please visit:

GST registration in Coimbatore

What Is Tax And Tax Types, And What Is Gst?- Manoj Gurukul - Manoj Gurukul Academy >>>>> Download Now

Delete>>>>> Download Full

What Is Tax And Tax Types, And What Is Gst?- Manoj Gurukul - Manoj Gurukul Academy >>>>> Download LINK

>>>>> Download Now

What Is Tax And Tax Types, And What Is Gst?- Manoj Gurukul - Manoj Gurukul Academy >>>>> Download Full

>>>>> Download LINK QP

ReplyDeleteIt is a good article thanks for share …

Chartered Accountant firm

Accounting Outsourcing Companies in India

Tax Consultant in India

Starting Business in India

Foreign investment approvals in India

indirect taxation firm in India

Direct tax consultancy in India

Registration of foreign companies

ReplyDeleteI recently read a blog on taxes, and it was incredibly informative! I gained so much knowledge about deductions, credits, and the overall tax filing process. The clear explanations and practical tips really helped demystify a topic that often feels overwhelming. I now feel much more confident in managing my finances and preparing my tax returns. Thanks to this blog, I was able to identify areas where I can save money and better plan for the future. I highly recommend it to anyone looking to improve their understanding of taxes!

GST Representation & GST Assessment